Recognizing Various Property Options for Better Investment Choices

In the dynamic world of actual estate investment, recognizing the varied choices offered is paramount for making sharp decisions. From the stability and appreciation possibility of properties to the greater income and expanded lease terms connected with industrial realty, each alternative presents distinct benefits. Real Estate Investment Company (REITs) use a more fluid and accessible type of investment, while property crowdfunding opens the door for smaller sized investors to get involved in rewarding possibilities. Additionally, vacation and rental buildings provide constant earnings streams in prime areas. Just how can capitalists best straighten these alternatives with their financial objectives and run the risk of resistance?

Residential Properties

Residential residential or commercial properties remain one of one of the most available and popular avenues for genuine estate financial investment. This property class includes a large range of residential property types, including single-family homes, multi-family devices, condominiums, townhouses, and getaway homes. The attractiveness of household actual estate hinges on its dual capability to give both rental earnings and potential for funding admiration.

Investors in homes can profit from a fairly secure and foreseeable capital through rental income. Market need for housing has a tendency to remain robust, driven by population growth, urbanization, and transforming household characteristics. Property homes usually value in value over time, enabling capitalists to exploit on long-lasting gains.

Reliable administration of houses is important for making the most of returns. This includes choosing the appropriate locations, guaranteeing correct maintenance, and setting affordable rental rates. Investors should additionally remain informed about local market fads, governing adjustments, and tenant choices to make educated decisions.

Financing alternatives for homes are generally a lot more obtainable contrasted to other realty categories. Mortgage rates for domestic financial investments usually use desirable terms, making it viable for a bigger variety of investors to go into the market. eastlake apartments seattle. This ease of access underscores the enduring charm of domestic actual estate as a foundation of diversified investment profiles

Industrial Real Estate

Another advantage of industrial actual estate is the possibility for professional relationships between tenants and proprietors. Organizations often tend to be extra financially stable and maintain their homes much better than individual renters, reducing the probability of tenant turnover and residential or commercial property damages. Furthermore, industrial residential properties usually experience reduced job rates, especially in prime areas where need for service room is regularly solid.

Financiers likewise take advantage of economic climates of range in industrial genuine estate. Managing a single huge building can be extra effective and affordable than managing multiple domestic units. Moreover, the recognition possibility for commercial residential or commercial properties can be significant, specifically in prospering economic problems, making them an appealing selection for long-lasting financial investment.

Real Estate Financial Investment Trusts (REITs)

One of the primary benefits of REITs is their liquidity. Unlike physical residential properties, REIT shares can be acquired and marketed on major supply exchanges, giving capitalists with better adaptability and simplicity of gain access to. Additionally, REITs are mandated by legislation to distribute a minimum of 90% of their gross income to shareholders in the form of returns, making them an attractive alternative for income-focused investors.

Realty Crowdfunding

Exploring the innovative landscape of realty crowdfunding exposes an interesting method for investors to take part in building endeavors with reasonably reduced resources commitments. This modern-day financial investment model allows several financiers to merge their resources to money realty jobs, typically managed with on the internet platforms. By equalizing accessibility to realty investments, crowdfunding enables individuals to take part in profitable opportunities that were historically scheduled for high-net-worth financiers.

Property crowdfunding platforms use a variety of financial investment alternatives, ranging from commercial residential properties to property developments. Investors can pick jobs that align with their threat resistance and financial objectives, supplying a level of customization not constantly readily available through you can try here standard financial investment approaches. Additionally, these platforms often give detailed details and efficiency metrics, encouraging financiers to make informed choices.

One of the main advantages of realty crowdfunding is its possibility for diversification. By investing smaller sized amounts across numerous projects, capitalists can reduce threats associated with single-property financial investments. In addition, the obstacle to access is substantially lower, with some systems allowing investments starting at simply a few hundred bucks. This ease of access cultivates better participation and can cause even more dynamic and affordable property markets.

Trip and Rental Properties

Investing in getaway and rental homes offers an engaging technique for producing regular income and long-lasting funding admiration. These financial investments typically involve purchasing homes in preferable locations that bring in vacationers or long-lasting occupants. By leveraging the need for short-term vacation rentals or secure month-to-month rental revenue, financiers can achieve significant economic returns.

The main advantage of getaway and rental residential properties is the possibility for greater rental returns. Popular vacationer destinations frequently command costs rental prices, specifically throughout peak periods. Furthermore, platforms like Airbnb and Vrbo have streamlined the procedure of handling short-term rentals, making it easier for homeowner to click site link with potential occupants and enhance bookings.

However, effective financial investment in vacation and rental residential properties needs careful factor to consider of numerous aspects. Place is paramount; properties in high-demand locations with strong tourist or job markets are more probable to attain occupancy and earnings. Financiers need to account for continuous maintenance expenses, residential property management costs, and regional laws that might affect rental operations.

Final Thought

In summary, understanding the varied range of property investment choices is important for making knowledgeable choices. Home provide stability and recognition, while business property supplies greater revenue and prolonged lease terms. REITs and realty crowdfunding facilitate liquid and obtainable financial investments for a more comprehensive audience. Getaway and rental residential properties better diversify revenue streams. Lining up these choices with private threat resistance and economic objectives makes it possible for critical financial investment preparation, inevitably boosting possible returns and profile strength.

While household buildings control lots of financial investment portfolios, industrial genuine estate provides distinct advantages that can improve diversification and yield considerable returns. Companies tend to be more financially secure and keep their properties better than individual renters, reducing the chance of renter turn over and home damage.As capitalists seek to broaden their profiles past conventional residential or commercial property possession, Real Estate Financial Investment Depends On (REITs) offer a compelling alternative. By spending in a portfolio of residential properties throughout geographical places and various industries, capitalists can alleviate risks connected with market fluctuations in particular areas or building kinds.Actual estate crowdfunding systems use a variety of investment choices, varying from commercial residential properties to property growths.

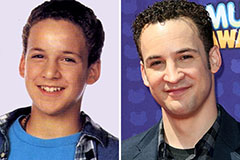

Ben Savage Then & Now!

Ben Savage Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!